What Does Write Off Uncollectible Mean . learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices. learn what uncollectible accounts receivable mean, how they impact your business, and how to handle them correctly. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. You should also write it off if they haven't shown any. Learn how to record and write off accounts. Learn how to estimate and. learn the difference between direct write off and provision methods for accounting for bad debts. accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. the general rule is to write off a bad debt when you're unable to connect with your client. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy.

from www.slideserve.com

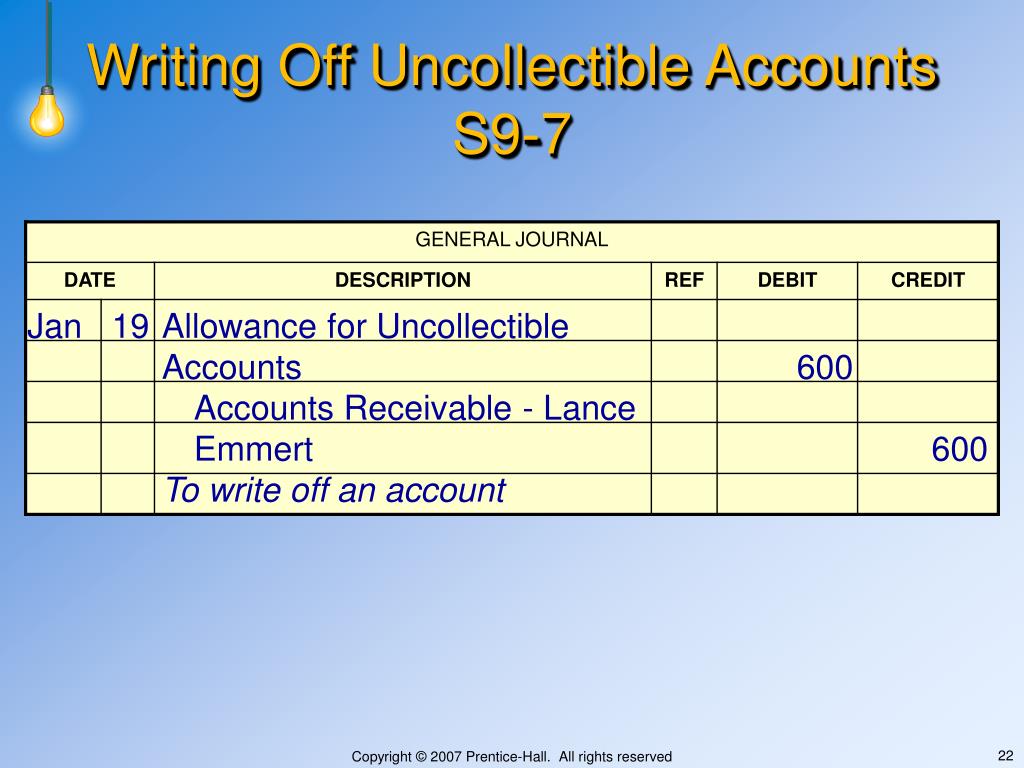

accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. Learn how to record and write off accounts. Learn how to estimate and. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. You should also write it off if they haven't shown any. learn the difference between direct write off and provision methods for accounting for bad debts. the general rule is to write off a bad debt when you're unable to connect with your client. learn what uncollectible accounts receivable mean, how they impact your business, and how to handle them correctly. learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices.

PPT Receivables PowerPoint Presentation, free download ID5961136

What Does Write Off Uncollectible Mean bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. You should also write it off if they haven't shown any. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. Learn how to estimate and. learn the difference between direct write off and provision methods for accounting for bad debts. learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices. Learn how to record and write off accounts. accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. learn what uncollectible accounts receivable mean, how they impact your business, and how to handle them correctly. the general rule is to write off a bad debt when you're unable to connect with your client.

From www.youtube.com

14.2 Writing off and collecting uncollectible accounts receivable YouTube What Does Write Off Uncollectible Mean the general rule is to write off a bad debt when you're unable to connect with your client. accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. learn what uncollectible accounts receivable mean, how they impact your business, and how to handle them correctly. bad debt expense is the cost. What Does Write Off Uncollectible Mean.

From slideplayer.com

The Direct WriteOff Method ppt download What Does Write Off Uncollectible Mean Learn how to estimate and. accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices. learn what uncollectible accounts receivable mean, how they impact your business, and how to handle them correctly. . What Does Write Off Uncollectible Mean.

From www.dreamstime.com

Direct Writeoff Method and Allowance Method for Bad Debt or What Does Write Off Uncollectible Mean bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. You should also write it off if they haven't shown any. learn the difference between direct write off and provision methods for accounting for. What Does Write Off Uncollectible Mean.

From slidetodoc.com

LESSON 17 1 Uncollectible Accounts Original created by What Does Write Off Uncollectible Mean learn the difference between direct write off and provision methods for accounting for bad debts. learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. learn what uncollectible accounts receivable. What Does Write Off Uncollectible Mean.

From www.chegg.com

Solved Record the entry to writeoff uncollectible What Does Write Off Uncollectible Mean Learn how to record and write off accounts. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. learn the difference between direct write off and provision methods for accounting for bad debts. bad. What Does Write Off Uncollectible Mean.

From slideplayer.com

LESSON 71 Direct WriteOff Method of Recording Uncollectible Accounts What Does Write Off Uncollectible Mean You should also write it off if they haven't shown any. the general rule is to write off a bad debt when you're unable to connect with your client. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. learn the difference between direct write off and provision methods for. What Does Write Off Uncollectible Mean.

From www.wizeprep.com

Recovering Writtenoff Accounts Wize University Introduction to What Does Write Off Uncollectible Mean the general rule is to write off a bad debt when you're unable to connect with your client. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. learn what uncollectible accounts receivable. What Does Write Off Uncollectible Mean.

From www.principlesofaccounting.com

Allowance Method For Uncollectibles What Does Write Off Uncollectible Mean bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. learn what uncollectible accounts receivable mean, how they impact your business, and how to handle them correctly. learn the difference between direct write off and provision methods for accounting for bad debts. bad debt write off is the process of. What Does Write Off Uncollectible Mean.

From www.slideserve.com

PPT Chapter 7 PowerPoint Presentation, free download ID3854857 What Does Write Off Uncollectible Mean learn the difference between direct write off and provision methods for accounting for bad debts. You should also write it off if they haven't shown any. the general rule is to write off a bad debt when you're unable to connect with your client. accounts uncollectible are debts that are unlikely to be paid, such as loans. What Does Write Off Uncollectible Mean.

From www.slideserve.com

PPT Receivables PowerPoint Presentation, free download ID5961136 What Does Write Off Uncollectible Mean learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices. You should also write it off if they haven't shown any. accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. bad debt write off is the process of removing uncollectible debts from. What Does Write Off Uncollectible Mean.

From accountingmethode.blogspot.com

Uncollectible Accounts Example Accounting Methods What Does Write Off Uncollectible Mean Learn how to record and write off accounts. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. Learn how to estimate and. the general rule is to write off a bad debt when you're unable to connect with your client. bad debt expense is the cost of uncollectible accounts. What Does Write Off Uncollectible Mean.

From fraud.net

Define WriteOff Schemes Fraud Definitions What Does Write Off Uncollectible Mean You should also write it off if they haven't shown any. learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices. learn what uncollectible accounts receivable mean, how they impact your business, and how to handle them correctly. Learn how to record and write off accounts. the general. What Does Write Off Uncollectible Mean.

From www.slideserve.com

PPT Chapter 6 PowerPoint Presentation, free download ID20942 What Does Write Off Uncollectible Mean Learn how to estimate and. Learn how to record and write off accounts. accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. learn when and how to deduct bad debts from your tax returns and. What Does Write Off Uncollectible Mean.

From www.slideserve.com

PPT Financial Assets PowerPoint Presentation, free download ID6049587 What Does Write Off Uncollectible Mean accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. bad debt write off is the process of removing uncollectible debts from a company’s records and acknowledging. Learn how to estimate and. learn when and how to deduct bad debts from your tax returns and avoid losing money on unpaid invoices. . What Does Write Off Uncollectible Mean.

From slideplayer.com

The Direct WriteOff Method ppt download What Does Write Off Uncollectible Mean Learn how to record and write off accounts. learn the difference between direct write off and provision methods for accounting for bad debts. the general rule is to write off a bad debt when you're unable to connect with your client. You should also write it off if they haven't shown any. bad debt write off is. What Does Write Off Uncollectible Mean.

From www.slideshare.net

Chapter 8 What Does Write Off Uncollectible Mean accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. learn the difference between direct write off and provision methods for accounting for bad debts. the general rule is to write off a bad debt. What Does Write Off Uncollectible Mean.

From www.slideserve.com

PPT Week 5 PowerPoint Presentation, free download ID252783 What Does Write Off Uncollectible Mean You should also write it off if they haven't shown any. bad debt expense is the cost of uncollectible accounts receivable due to customer default or bankruptcy. the general rule is to write off a bad debt when you're unable to connect with your client. learn what uncollectible accounts receivable mean, how they impact your business, and. What Does Write Off Uncollectible Mean.

From www.youtube.com

Topic 12.2 The Direct Write Off and Allowance Methods (Accounting for What Does Write Off Uncollectible Mean accounts uncollectible are debts that are unlikely to be paid, such as loans or receivables. Learn how to record and write off accounts. Learn how to estimate and. learn the difference between direct write off and provision methods for accounting for bad debts. You should also write it off if they haven't shown any. learn when and. What Does Write Off Uncollectible Mean.