How Much Is Sales Tax On A Used Car In Ontario . yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. As with other uses of the.

from www.carsalerental.com

the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. As with other uses of the. rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the.

How Much Sales Tax On A Used Car In Ontario Car Sale and Rentals

How Much Is Sales Tax On A Used Car In Ontario when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. As with other uses of the. Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the.

From dxobodalh.blob.core.windows.net

How Is Sales Tax Calculated On A Used Car In Ontario at Scott McKinney blog How Much Is Sales Tax On A Used Car In Ontario the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. As with other uses of the. Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. rst at the rate of 13 per cent is payable on the fair market. How Much Is Sales Tax On A Used Car In Ontario.

From brokerdash.surex.com

How Much Tax Do You Pay on a Used Car in Ontario Surex How Much Is Sales Tax On A Used Car In Ontario when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. yes, you’ll need to pay 13% hst (harmonized sales. How Much Is Sales Tax On A Used Car In Ontario.

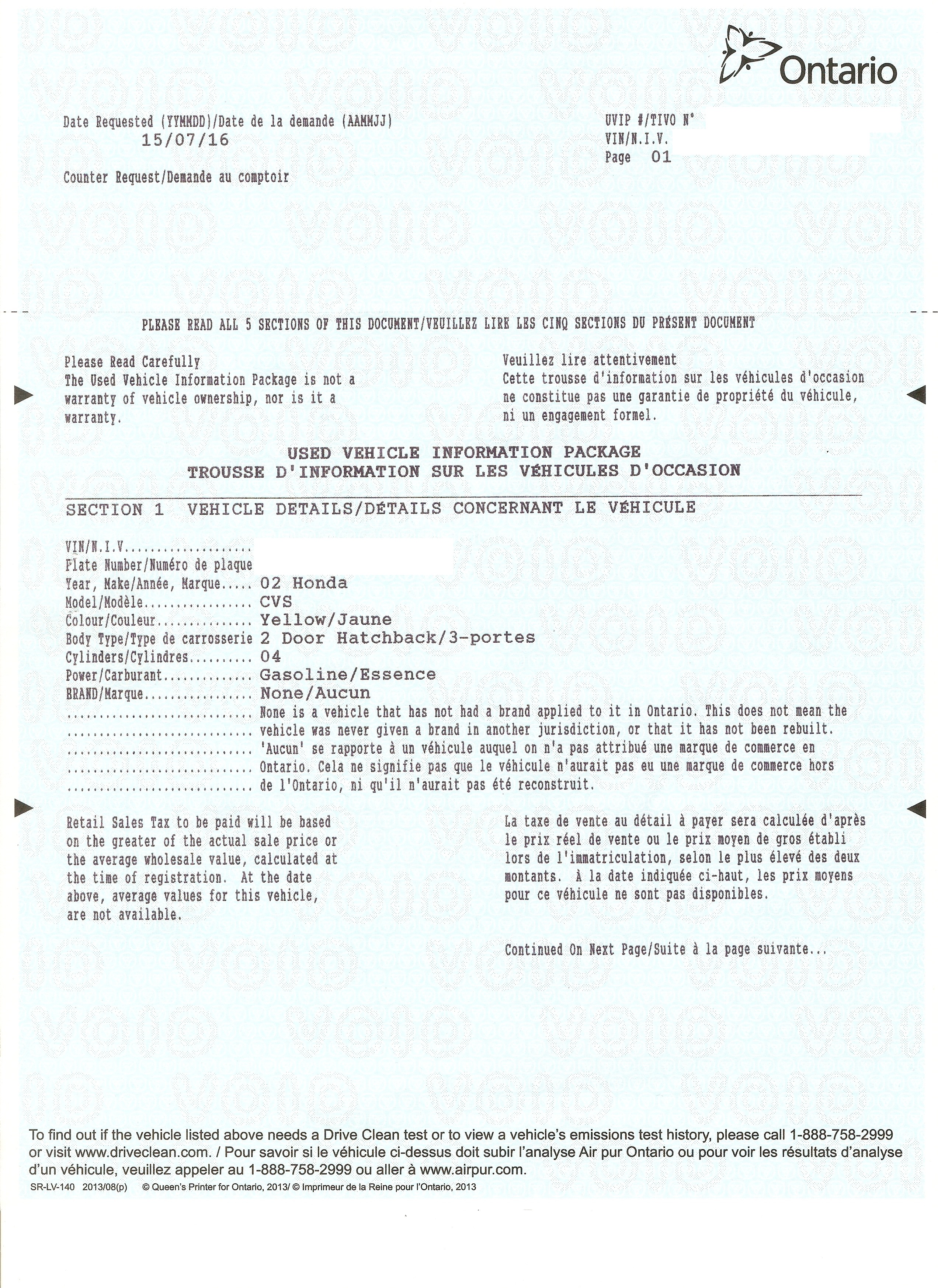

From www.myusedcar.ca

Ontario UVIP Used Vehicle Information Package Used Car Toronto How Much Is Sales Tax On A Used Car In Ontario rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. As with other uses of the. yes, you’ll need to. How Much Is Sales Tax On A Used Car In Ontario.

From www.finder.com

How to Sell a Car in Ontario Tips & Required Docs Finder Canada How Much Is Sales Tax On A Used Car In Ontario the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial. How Much Is Sales Tax On A Used Car In Ontario.

From www.carsalerental.com

Selling A Used Car In Ontario Bill Of Sale Car Sale and Rentals How Much Is Sales Tax On A Used Car In Ontario car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase. How Much Is Sales Tax On A Used Car In Ontario.

From www.slideserve.com

PPT BILL OF SALE TEMPLATE ONTARIO FREE DOWNLOAD.pdf PowerPoint How Much Is Sales Tax On A Used Car In Ontario car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. yes, you’ll need to pay 13% hst (harmonized sales tax) when. How Much Is Sales Tax On A Used Car In Ontario.

From privateauto.com

How Much Are Used Car Sales Taxes in Texas? How Much Is Sales Tax On A Used Car In Ontario yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. As with other uses of the. Free resource and calculator to help estimate. How Much Is Sales Tax On A Used Car In Ontario.

From exobsfjvx.blob.core.windows.net

What Is The Sales Tax In Ontario For Used Cars at Randy Edwards blog How Much Is Sales Tax On A Used Car In Ontario when buying a used car from a dealer, you must pay both the federal sales tax (gst) and the provincial sales tax, the. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). rst at the rate of 13 per cent is payable on. How Much Is Sales Tax On A Used Car In Ontario.

From www.carsalerental.com

How Much Sales Tax On A Used Car In Ontario Car Sale and Rentals How Much Is Sales Tax On A Used Car In Ontario yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. rst at the rate of 13 per cent is payable on the fair market value of. How Much Is Sales Tax On A Used Car In Ontario.

From diycanadian.com

How to Sell a Car in Ontario, Canada How Much Is Sales Tax On A Used Car In Ontario rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when buying a used car from a dealer, you must pay both. How Much Is Sales Tax On A Used Car In Ontario.

From www.ucda.org

New Vehicle Bill of Sale The Used Car Dealers Association of Ontario How Much Is Sales Tax On A Used Car In Ontario Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. . How Much Is Sales Tax On A Used Car In Ontario.

From www.carsalerental.com

When Do I Pay Sales Tax On A New Car Car Sale and Rentals How Much Is Sales Tax On A Used Car In Ontario rst at the rate of 13 per cent is payable on the fair market value of a specified vehicle purchased privately (i.e., from a person. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). Free resource and calculator to help estimate provincial/territorial and federal. How Much Is Sales Tax On A Used Car In Ontario.

From loanscanada.ca

Car Sales Tax On New And Used Vehicles In Canada Loans Canada How Much Is Sales Tax On A Used Car In Ontario As with other uses of the. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). the ontario tax on used vehicles is 13%,. How Much Is Sales Tax On A Used Car In Ontario.

From exobsfjvx.blob.core.windows.net

What Is The Sales Tax In Ontario For Used Cars at Randy Edwards blog How Much Is Sales Tax On A Used Car In Ontario Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. As with other uses of the. when buying a used car from a dealer, you must pay both the federal sales tax. How Much Is Sales Tax On A Used Car In Ontario.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals How Much Is Sales Tax On A Used Car In Ontario As with other uses of the. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). Free resource and calculator to help estimate provincial/territorial and. How Much Is Sales Tax On A Used Car In Ontario.

From privateauto.com

How Much are Used Car Sales Taxes in West Virginia? How Much Is Sales Tax On A Used Car In Ontario car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). when you buy a used car in ontario, you’ll need to pay the hst (harmonized sales tax) of 13 per cent. the ontario tax on used vehicles is 13%, with 5% going to the. How Much Is Sales Tax On A Used Car In Ontario.

From privateauto.com

How Much are Used Car Sales Taxes in Indiana? How Much Is Sales Tax On A Used Car In Ontario the ontario tax on used vehicles is 13%, with 5% going to the federal government and 8% going to the provincial government. yes, you’ll need to pay 13% hst (harmonized sales tax) when you purchase a used vehicle from a used car. Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used.. How Much Is Sales Tax On A Used Car In Ontario.

From www.carsalerental.com

Sample Used Car Bill Of Sale Ontario Car Sale and Rentals How Much Is Sales Tax On A Used Car In Ontario As with other uses of the. Free resource and calculator to help estimate provincial/territorial and federal taxes owing on new and used. car buyers pay 13% sales tax in ontario based on the purchase price of the vehicle or its wholesale value (whichever is greater). the ontario tax on used vehicles is 13%, with 5% going to the. How Much Is Sales Tax On A Used Car In Ontario.